دوراتنا

Get Started With Tableau

Tableau is a powerful software program frequently used by business analysts in a variety of departments including sales, marketing, finance, operation and more. Analysts within these departments use Tableau to create visualizations that explain datasets and tell data stories. In this project, learners will learn the basic steps to begin using Tableau. They will learn how to upload data and how the user interface works. Learners will move on to understand the difference between dimensions and measures as well as discrete and concrete variables.

-

Course by

-

Self Paced

Self Paced

-

3 ساعات

3 ساعات

-

الإنجليزية

الإنجليزية

Introduction to Finance: The Role of Financial Markets

In Introduction to Finance: The Role of Financial Markets, you will be introduced to the basic concepts and skills needed for financial managers to make informed decisions. With an overview of the structure and dynamics of financial markets and commonly used financial instruments, you will get crucial skills to make capital investment decisions. With these skills, you will be ready to understand how to measure returns and risks and establish the relationship between these two.

-

Course by

-

Self Paced

Self Paced

-

19 ساعات

19 ساعات

-

الإنجليزية

الإنجليزية

Valuation for Startups Using Discounted Cash Flows Approach

Discounted cash flow method means that we can find firm value by discounting future cash flows of a firm. That is, firm value is present value of cash flows a firm generates in the future. In order to understand the meaning of present value, we are going to discuss time value of money, first. That is, the value of $100 today is different from the value of $100 a year later. Then, what should be the present value of $100 that you are going to receive in 1 year? How about the value of $100 dollars that you are going to receive every year for next 10 years? How about forever?

-

Course by

-

Self Paced

Self Paced

-

8 ساعات

8 ساعات

-

الإنجليزية

الإنجليزية

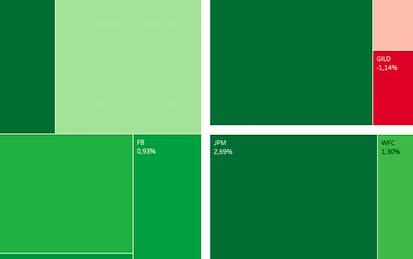

Building Stock Returns Heatmap with Tableau

In this 1-hour long project-based course, you will learn how to extract stock data using Google Finance, build a Heat and Treemap in Tableau, build a stock returns dashboard in Tableau.

Note: This course works best for learners who are based in the North America region. We're currently working on providing the same experience in other regions.

This course's content is not intended to be investment advice and does not constitute an offer to perform any operations in the regulated or unregulated financial market.

-

Course by

-

Self Paced

Self Paced

-

2 ساعات

2 ساعات

-

الإنجليزية

الإنجليزية

The Role of Global Capital Markets

In this course, participants will learn about how different markets around the world can interact to create value for, and effectively manage the risk of, corporations and their stakeholders. This is part of a Specialization in corporate finance created in partnership between the University of Melbourne and Bank of New York Mellon (BNY Mellon). View the MOOC promotional video here: http://tinyurl.com/j7wyowo

-

Course by

-

Self Paced

Self Paced

-

17 ساعات

17 ساعات

-

الإنجليزية

الإنجليزية

Fundamentals of Finance

Welcome to Fundamentals of Finance. This 4 module course will help you understand and affect the performance of your unit or organization’s profitability. By the end of this course, you will be able to implement finance and accounting concepts to drive your organization's growth, analyze financial statements and understand the factors in productivity and profitability, and create forecasting and budgeting. You will also have the ability to evaluate and manage cash flow, implement strategies around financing, and use of ratios in running a business.

-

Course by

-

Self Paced

Self Paced

-

10 ساعات

10 ساعات

-

الإنجليزية

الإنجليزية

Value and Individual Decision Making

This course is part of a Specialization titled “Strategy and Finance for a Lifecycle of a Social Business”. It is an introduction to time value of money and will help the learner understand the basics of finance with the ultimate goal of valuing a company from a societal lens. The beauty of the modern decision-making framework is that it can be used to understand value creation at any level – the individual, the corporate or nonprofit entity level and from the point of view of society.

-

Course by

-

Self Paced

Self Paced

-

26 ساعات

26 ساعات

-

الإنجليزية

الإنجليزية

Introduction to Financial Analysis - The "Why?"

In this course, you will learn the foundations important to developing and implementing a financially analytic mindset. This course introduces the foundations of financial analysis, beginning with the first question: what is financial analysis? You will learn about the importance of adopting and applying a financial perspective. You will learn about accounting and finance principles and fundamentals. Accounting principles allow for the creation of consistent and reliable financial information.

-

Course by

-

Self Paced

Self Paced

-

12 ساعات

12 ساعات

-

الإنجليزية

الإنجليزية

Finance of Mergers and Acquisitions: Designing an M&A Deal

This course focuses on the theory and practice of mergers and acquisitions (M&A), with a focus on the Finance. The Finance of M&A uses tools from different areas of Finance to help managers and investment bankers design successful M&A deals. In particular, we will learn to value and price M&A deals and how to choose the optimal financing mix for an M&A deal. The course focuses on all the major types of M&A deals including strategic M&A, private equity leveraged buyouts (LBOs), and restructuring deals such spinoffs and asset transfers.

-

Course by

-

Self Paced

Self Paced

-

20 ساعات

20 ساعات

-

الإنجليزية

الإنجليزية

Forming, Funding, & Launching a Startup Company

This course starts with a close look at entrepreneurial finance, revenue models, and sources of startup funding. Learners will build a revenue model, create a Financial Plan for a new startup idea, and prepare an investo…

-

Course by

-

Self Paced

Self Paced

-

الإنجليزية

الإنجليزية

Using Machine Learning in Trading and Finance

This course provides the foundation for developing advanced trading strategies using machine learning techniques. In this course, you’ll review the key components that are common to every trading strategy, no matter how complex. You’ll be introduced to multiple trading strategies including quantitative trading, pairs trading, and momentum trading.

-

Course by

-

Self Paced

Self Paced

-

19 ساعات

19 ساعات

-

الإنجليزية

الإنجليزية

Global Systemic Risk

What is globalization and how does it work? How can we understand the process as a whole? How are the parts of the world linked? What are the risks of living in a world where “no one is in charge”? This course introduces students to systems thinking, network theory, and risk analysis and uses these tools to better understand the process of globalization. Focusing on trade, finance, and epidemiology, it analyzes potential challenges to the current global order. The course will be of interest to those studying global affairs, system dynamics, and world governance.

-

Course by

-

Self Paced

Self Paced

-

21 ساعات

21 ساعات

-

الإنجليزية

الإنجليزية

Supply Chain Excellence

This Specialization is an advanced view to the fascinating world of Supply Chain Management. When you complete the program you'll have a richer understanding of the complexities that companies are facing in today's global networked economy. The Specialization is for you, if: 1. have taken our introductory specialization in Supply Chain Management and want to learn more; 2. you have some experience in Supply Chain Management and want to understand the topic better; 3. you're fascinated by how the global economy is linked together by the flow of products, information, and finances.

-

Course by

-

Self Paced

Self Paced

-

الإنجليزية

الإنجليزية

Supporting Veteran Success in Higher Education

This course is designed to be a training that familiarizes any faculty or staff member at a college or university with military and veteran culture as well as veteran-specific considerations in the areas of admissions, finances, academic and student life, and health and well-being. Our hope is that the information provided here will deepen the understanding of student veterans, resulting in a more veteran inclusive campus.

-

Course by

-

34 ساعات

34 ساعات

-

الإنجليزية

الإنجليزية

Investment Banking: Financial Analysis and Valuation

This course will provide students the key building blocks required for a career in investment banking, valuation, and other corporate-finance focused fields. It is designed to provide a practical application of financial statement analysis and valuation techniques commonly performed by industry professionals. The course has two major parts.

-

Course by

-

Self Paced

Self Paced

-

14 ساعات

14 ساعات

-

الإنجليزية

الإنجليزية

Essentials of Corporate Finance Capstone

The Capstone Project is the final part of the Essentials of Corporate Financial Analysis and Decision-Making MOOC Specialization. The Capstone is designed to allow students to bring together the skills acquired and knowledge gained over the preceding four courses of the Specialization by taking on the role of a financial analyst tasked with advising a wealthy private client on a significant strategic investment in a large listed firm operating across the globe. View the MOOC promotional video here: http://tinyurl.com/j9fqv25

-

Course by

-

Self Paced

Self Paced

-

10 ساعات

10 ساعات

-

الإنجليزية

الإنجليزية

Innovation Demystified: Tools for Finance Professionals

Introducing the tools, methods and mindset that will enable contributions to any organizations’ innovation agenda, this course illustrates practical techniques specific to driving innovation. You will learn how and why leading, measuring, and executing innovation takes tools, methods and mindset different from those used to operate an established business.

-

Course by

-

Self Paced

Self Paced

-

9 ساعات

9 ساعات

-

الإنجليزية

الإنجليزية

ESG-focused Financial Products

As ESG investing continues to evolve, so do the funding mechanisms many companies, organizations, and governments use to finance their stated goals. Indeed, ESG-focused financial products, or ‘green assets’, have been growing in volume – as well as by type.

-

Course by

-

Self Paced

Self Paced

-

22 ساعات

22 ساعات

-

الإنجليزية

الإنجليزية

Finance for Everyone Capstone Project

Each course in F4E offers key insights and knowledge you will be able to apply in real-life situations. You’ll test drive those insights through activities and assessments that will influence your key money Decisions, your participation in financial Markets, your experience in preserving or creating Value, and in managing Debt. These activities are designed to immerse you in financial thinking by giving you a safe environment for buying and selling and for making, creating, simulating, writing, and teaching.

-

Course by

-

Self Paced

Self Paced

-

9 ساعات

9 ساعات

-

الإنجليزية

الإنجليزية

Introduction to Finance: The Basics

In the Introduction to Finance I: The Basics course, you will be introduced to the basic concepts needed to understand the financial manager’s decision-making process. To achieve that, you will learn about the basic forms a business can take and the goal of the financial manager. You will also learn the fundamentals of financial statements and how to measure a company’s financial health using financial ratios. In addition, you will explore how to allocate capital across time to create value.

-

Course by

-

Self Paced

Self Paced

-

19 ساعات

19 ساعات

-

الإنجليزية

الإنجليزية

Understanding Your Google Cloud Costs

Understanding Your Google Cloud Costs is most suitable for those working in a technology or finance role who are responsible for managing Google Cloud costs. You’ll learn how to set up a billing account, organize resources, and manage billing access permissions. In the hands-on labs, you'll learn how to view your invoice, track your Google Cloud costs with Billing reports, analyze your billing data with BigQuery or Google Sheets, and create custom billing dashboards with Looker Studio. Students enrolling in this course do not need any prior Google Cloud technical experience.

-

Course by

-

Self Paced

Self Paced

-

5 ساعات

5 ساعات

-

الإنجليزية

الإنجليزية

Risk Management in Personal Finance

This course is primarily aimed at those who want to understand more about how they can protect their finances from unexpected events. Taught by a CERTIFIED FINANCIAL PLANNER™ Professional, this course covers the role insurance plays into your financial plan, including what kinds of insurance to explore, how to determine how much insurance you need, and how different kinds of insurance works. The course includes life insurance, health insurance, disability insurance, homeowners insurance, renters insurance, auto insurance, and umbrella insurance.

-

Course by

-

Self Paced

Self Paced

-

7 ساعات

7 ساعات

-

الإنجليزية

الإنجليزية

Intro to Finance in Healthcare

This course is best suited for individuals currently in the healthcare sector, as a provider, payer, or administrator. Individuals pursuing a career change to the healthcare sector may also be interested in this course. In this course, you will have an opportunity to explore concepts and topics related to accounting and finance basics for healthcare organizations.

-

Course by

-

Self Paced

Self Paced

-

الإنجليزية

الإنجليزية

Managing Responsibly: Practicing Sustainability, Responsibility and Ethics

Managers are increasingly confronted with issues of sustainability, responsibility and ethics. Managing responsibly is an integrative approach to sustainability, responsibility and ethics, which allows you as a manager to deal competently with such challenges. This course will facilitate your learning process to engage in changing practices to make them more sustainable, responsible, and ethically informed. We will first introduce the context of the trend towards responsible management practices (week 1).

-

Course by

-

Self Paced

Self Paced

-

22 ساعات

22 ساعات

-

الإنجليزية

الإنجليزية

Product Cost and Investment Cash Flow Analysis

This course discusses costs and business practices to establish the cost of a product. The concept of time value of money (TVM) is developed to determine the present and future values of a series of cash flows. TVM principles are then applied to personal finances and retirement planning. This is a practical course that uses spreadsheets to better prepare learners in engineering and science for a career in industry. This course can be taken for academic credit as part of CU Boulder’s Master of Engineering in Engineering Management (ME-EM) degree offered on the Coursera platform.

-

Course by

-

Self Paced

Self Paced

-

20 ساعات

20 ساعات

-

الإنجليزية

الإنجليزية