Our Courses

Renewable Energy and Green Building Entrepreneurship

Welcome to the course where you learn to launch a new business in the energy, finance, real estate, design, engineering, or environmental sectors, while also helping you create positive environmental and human health impacts around the world. We will integrate tools, trends, and tips from the field of entrepreneurship as a career path for making a difference and generating wealth in the renewable energy and green building sectors. This is not a course about theory.

-

Course by

-

Self Paced

Self Paced

-

18 hours

18 hours

-

English

English

Finance for Startups

Finance is one of the key ingredients for successful startups. Many entrepreneurs, however, lack knowledge of finance. This course teaches basic financial knowledge needed in starting and operating startups to entrepreneurs or would-be entrepreneurs who did not major in finance. Students of this course will learn to read and understand financial statements such as balance sheets, income statements and cash flow statements. They will also practice simple financial planning of a startup. This course also covers the concept company valuation as well as how startups get funding.

-

Course by

-

Self Paced

Self Paced

-

6 hours

6 hours

-

English

English

Pre-MBA Quantitative Skills: Finance

This short course surveys all the major topics covered in a full semester MBA level finance course, but with a more intuitive approach on a very high conceptual level. The goal here is give you a roadmap and framework for how financial professional make decisions.

-

Course by

-

Self Paced

Self Paced

-

14 hours

14 hours

-

English

English

Capstone: Build a Winning Investment Portfolio

Put your investment and portfolio management knowledge to the test through five weeks of hands-on investment experiences: • Developing and managing your own simulated investment portfolio, resulting in a peer-graded report covering portfolio strategy, analysis, and performance • Advising case study clients on a variety of investment topics, essentially acting as an investment advisor in a simulated environment recommending strategies for and changes in portfolios based on challenges and issues faced by your clients • Using the sophisticated web-based analytical tools of Silicon Cloud Techn

-

Course by

-

Self Paced

Self Paced

-

10 hours

10 hours

-

English

English

Global Financing Solutions (by EDHEC and Société Générale)

The MOOC Global Financing Solutions is your online gateway to better understanding of the dynamics of Finance, and its role at the very heart of promoting the “real economy” and global growth. Concretely, you will learn how companies finance themselves using banks and capital markets and how Environmental, Social and Corporate Governance criteria are now deeply integrated in all financing processes. We will look at the role of syndication, and how it links issuers looking to raise capital to grow their businesses with investors looking to manage their assets and possibly liabilities.

-

Course by

-

Self Paced

Self Paced

-

English

English

Value and Business Decision Making

This course is part of a Specialization titled “Strategy and Finance for a Lifecycle of a Social Business”. It is an introduction to time value of money and will help the learner understand the basics of finance with the ultimate goal of valuing a company from a societal lens. The beauty of the modern decision-making framework is that it can be used to understand value creation at any level – the individual, the corporate or nonprofit entity level and from the point of view of society.

-

Course by

-

Self Paced

Self Paced

-

30 hours

30 hours

-

English

English

Macroeconomic Financial Accounts

This course is primarily aimed at undergraduates attending their final year or University students in monetary and financial economics, international macroeconomics and data mining. Professionals in Government institutions, Central Banks, business and the financial industry, along with other professionals interested in finance and macroeconomics, may also benefit from this course.

-

Course by

-

Self Paced

Self Paced

-

28 hours

28 hours

-

English

English

The Art and Science of Economic Policy

Economic policy affects every citizen. And economic policymaking is best done as a collaborative process with a wide range of stakeholders. This course brings an understanding of the relevance and impacts of economic policymaking in everyday life, and the ways for citizens to be involved in shaping economic policy, in an accessible and interesting manner. Taught by Dr. Vijay Kelkar and Dr.

-

Course by

-

Self Paced

Self Paced

-

13 hours

13 hours

-

English

English

Valuing nature and people to inform business decision-making

The aim of the course is to introduce businesses employees to the Capitals Approach and help them to get started with integrating natural, social and human capitals into business decision-making. This course is an introductory course; no prior knowledge of natural, human or social capital is needed.

-

Course by

-

Self Paced

Self Paced

-

20 hours

20 hours

-

English

English

New Venture Finance: Startup Funding for Entrepreneurs

This course is for aspiring or active entrepreneurs who wants to understand how to secure funding for their company. This course will demystify key financing concepts to give entrepreneurs and aspiring entrepreneurs a guide to secure funding. Examine the many financing options available to get your new venture funded. Learn the basics of finance, valuations, dilution and non-dilutive funding sources. Understand capital structure for new ventures, term sheets and how to negotiate them, and the differences between early-stage versus later-stage financing.

-

Course by

-

Self Paced

Self Paced

-

20 hours

20 hours

-

English

English

Interactive Statistical Data Visualization 101

In this guided project, we will explore plotly express to visualize statistical plots such as box plots, histograms, heatmaps, density maps, contour plots, and violin plots. Plotly express is a super powerful Python package that empowers anyone to create, manipulate and render graphical figures. This crash course is super practical and directly applicable to many industries such as banking, finance and tech industries. Note: This course works best for learners who are based in the North America region. We’re currently working on providing the same experience in other regions.

-

Course by

-

Self Paced

Self Paced

-

3 hours

3 hours

-

English

English

Risk, Return and Valuation

This course is part of a Specialization titled “Strategy and Finance for a Lifecycle of a Social Business”, with a follow-on project-based course on understanding and evaluating a business focused on addressing a societal issue. The beauty of a modern decision-making framework is that it can be used to understand value creation at any level – the individual or business or societal. The applications however become increasingly complex as your lens expands from the individual to the corporate/nonprofit to the global society.

-

Course by

-

Self Paced

Self Paced

-

34 hours

34 hours

-

English

English

Supply Chain Finance Market and Fintech Ecosystem

This course provides an in-depth understanding of the Supply Chain Finance market including insights on the potential and current market size, market penetration, growth, and distribution. You’ll be introduced to the four distinctive groups serving the Supply Chain Finance market and learn about the main stakeholders and market participants in a Supply Chain Finance program.

-

Course by

-

Self Paced

Self Paced

-

7 hours

7 hours

-

English

English

Fundamentals of Financial Planning, with Goldman Sachs 10,000 Women

This free online course is one of 10 courses available in the Goldman Sachs 10,000 Women collection, designed for entrepreneurs ready to take their business to the next level. In this course, you will understand the value of financial planning and how it can help you to assess business opportunities. You will consider the cash flow cycle of your company and its impact on business growth and success.

-

Course by

-

Self Paced

Self Paced

-

3 hours

3 hours

-

English

English

Create a Promotional Video using Canva

In this 1-hour long project-based course, you will learn how to create a script and then create a Promotional Video around it and make the video appealing using video backgrounds, images and animations. By the end of this project, you will be confident in creating an eye-catching and professional Promotional Video in Canva which you can use to Market on Social Media Platforms. The same skills can be used in creating Promotional Video in any industry like real estate, finance, healthcare or for any other business.

-

Course by

-

Self Paced

Self Paced

-

3 hours

3 hours

-

English

English

Create Technical Stock Charts Using R and Quantmod

In this 1-hour long project-based course, you will learn how to pull down Stock Data using the R quantmod Package and Yahoo Finance API.

-

Course by

-

Self Paced

Self Paced

-

3 hours

3 hours

-

English

English

Get Started With Tableau

Tableau is a powerful software program frequently used by business analysts in a variety of departments including sales, marketing, finance, operation and more.

-

Course by

-

Self Paced

Self Paced

-

3 hours

3 hours

-

English

English

Introduction to Finance: The Role of Financial Markets

In Introduction to Finance: The Role of Financial Markets, you will be introduced to the basic concepts and skills needed for financial managers to make informed decisions. With an overview of the structure and dynamics of financial markets and commonly used financial instruments, you will get crucial skills to make capital investment decisions. With these skills, you will be ready to understand how to measure returns and risks and establish the relationship between these two.

-

Course by

-

Self Paced

Self Paced

-

19 hours

19 hours

-

English

English

Valuation for Startups Using Discounted Cash Flows Approach

Discounted cash flow method means that we can find firm value by discounting future cash flows of a firm. That is, firm value is present value of cash flows a firm generates in the future. In order to understand the meaning of present value, we are going to discuss time value of money, first. That is, the value of $100 today is different from the value of $100 a year later. Then, what should be the present value of $100 that you are going to receive in 1 year? How about the value of $100 dollars that you are going to receive every year for next 10 years? How about forever?

-

Course by

-

Self Paced

Self Paced

-

8 hours

8 hours

-

English

English

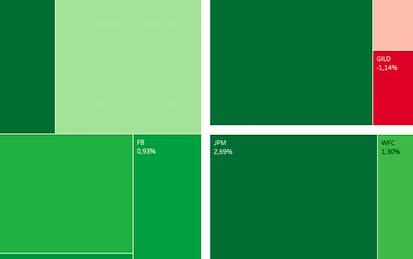

Building Stock Returns Heatmap with Tableau

In this 1-hour long project-based course, you will learn how to extract stock data using Google Finance, build a Heat and Treemap in Tableau, build a stock returns dashboard in Tableau.

-

Course by

-

Self Paced

Self Paced

-

2 hours

2 hours

-

English

English

The Role of Global Capital Markets

In this course, participants will learn about how different markets around the world can interact to create value for, and effectively manage the risk of, corporations and their stakeholders. This is part of a Specialization in corporate finance created in partnership between the University of Melbourne and Bank of New York Mellon (BNY Mellon). View the MOOC promotional video here: http://tinyurl.com/j7wyowo

-

Course by

-

Self Paced

Self Paced

-

17 hours

17 hours

-

English

English

Fundamentals of Finance

Welcome to Fundamentals of Finance. This 4 module course will help you understand and affect the performance of your unit or organization’s profitability. By the end of this course, you will be able to implement finance and accounting concepts to drive your organization's growth, analyze financial statements and understand the factors in productivity and profitability, and create forecasting and budgeting. You will also have the ability to evaluate and manage cash flow, implement strategies around financing, and use of ratios in running a business.

-

Course by

-

Self Paced

Self Paced

-

10 hours

10 hours

-

English

English

Value and Individual Decision Making

This course is part of a Specialization titled “Strategy and Finance for a Lifecycle of a Social Business”. It is an introduction to time value of money and will help the learner understand the basics of finance with the ultimate goal of valuing a company from a societal lens. The beauty of the modern decision-making framework is that it can be used to understand value creation at any level – the individual, the corporate or nonprofit entity level and from the point of view of society.

-

Course by

-

Self Paced

Self Paced

-

26 hours

26 hours

-

English

English

Introduction to Financial Analysis - The "Why?"

In this course, you will learn the foundations important to developing and implementing a financially analytic mindset. This course introduces the foundations of financial analysis, beginning with the first question: what is financial analysis? You will learn about the importance of adopting and applying a financial perspective. You will learn about accounting and finance principles and fundamentals. Accounting principles allow for the creation of consistent and reliable financial information.

-

Course by

-

Self Paced

Self Paced

-

12 hours

12 hours

-

English

English

Finance of Mergers and Acquisitions: Designing an M&A Deal

This course focuses on the theory and practice of mergers and acquisitions (M&A), with a focus on the Finance. The Finance of M&A uses tools from different areas of Finance to help managers and investment bankers design successful M&A deals. In particular, we will learn to value and price M&A deals and how to choose the optimal financing mix for an M&A deal. The course focuses on all the major types of M&A deals including strategic M&A, private equity leveraged buyouts (LBOs), and restructuring deals such spinoffs and asset transfers.

-

Course by

-

Self Paced

Self Paced

-

20 hours

20 hours

-

English

English